Marriage tax calculator

You need to be. TPC has updated the calculator to include the recently-enacted Tax Cuts.

Tax Rate Calculator Flash Sales 54 Off Www Ingeniovirtual Com

Single Married Filing Jointly Married.

. The calculator shows the difference in income taxes owed for couples before and after they tie the knot. Taxable Amount calculated Tax Multiplier. How the marriage tax allowance is calculated The partner who has an unused amount of personal allowance can transfer 1260 of their allowance to the other so basically 10 of the full.

This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. Total ValueSales Price of Property. For 2020 youll notice that the highest-income earners pay a 37 tax rate if income is over 622050 married filing jointly and single filers will pay that rate when income exceeds.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. This means as a couple you are paying Income Tax on 7430.

Married Couples are missing out on up to 1188 MARRIAGE TAX CALCULATOR 1 ELIGIBILITY2 DECISION3 INCOME4 PERSONAL5 SIGN Youre just seconds away from finding out if you are. This calculator shows marginal rates for the current year. You might be owed a Marriage Tax Refund of up to 1188 It takes.

Your partners income is 20000 and their Personal Allowance is 12570 so they pay tax on 7430 their taxable income. Home Government Elected Officials County Recorder Real Property RPTT Calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Marriage Allowance - Tax Refund Calculator Can I Claim A Marriage Tax Refund. While the threshold for single filers is 200000 married couples will start paying the tax when their income hits 250000. There are more than 22 million couples in the UK missing out on a tax rebate of up to 1188.

Your household income location filing status and number of personal. For the tax year 2021 the maximum tax rate for individual single taxpayers with earnings over 523600 628300 for married couples filing jointly remains 37 percent. Your household income location filing status and number of personal.

1220 you could be entitled to 24 million couples still to claim No paperwork needed Reduce your tax payments by up to 250 per year Lifetime tax reduction of up to 10000 Start your. This means that youll pay 186 more if you are married than if you are not. Marriage tax calculator 2020.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Generally Advance Premium Tax Credit APTC received in excess. Calculator Variables and Results Tax Year Choose the year that you want to calculate your US Federal Tax Filing Status Choose one of the following.

Income Tax Calculate your Married Couples Allowance You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get. By On June 1 2021 0 Comments On June 1 2021 0 Comments. Married couples who receive the earned income tax.

The calculator automatically determines whether the standard or itemized deduction based on inputs will result in the largest tax savings and uses the larger of the two values in the. It compares the taxes a married couple would pay filing a joint. Use our accountancy services to see if you qualify for eligible tax reliefs potentially resulting in 000s Marriage Allowance Eligible couples are owed up to 1150 in tax relief check your.

Are you married or in a civil partnership.

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

Can A Married Person File Taxes Without Their Spouse

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate 2019 Federal Income Withhold Manually

Marriage Penalty Vs Marriage Bonus How Taxes Work

Can A Married Person File Taxes Without Their Spouse

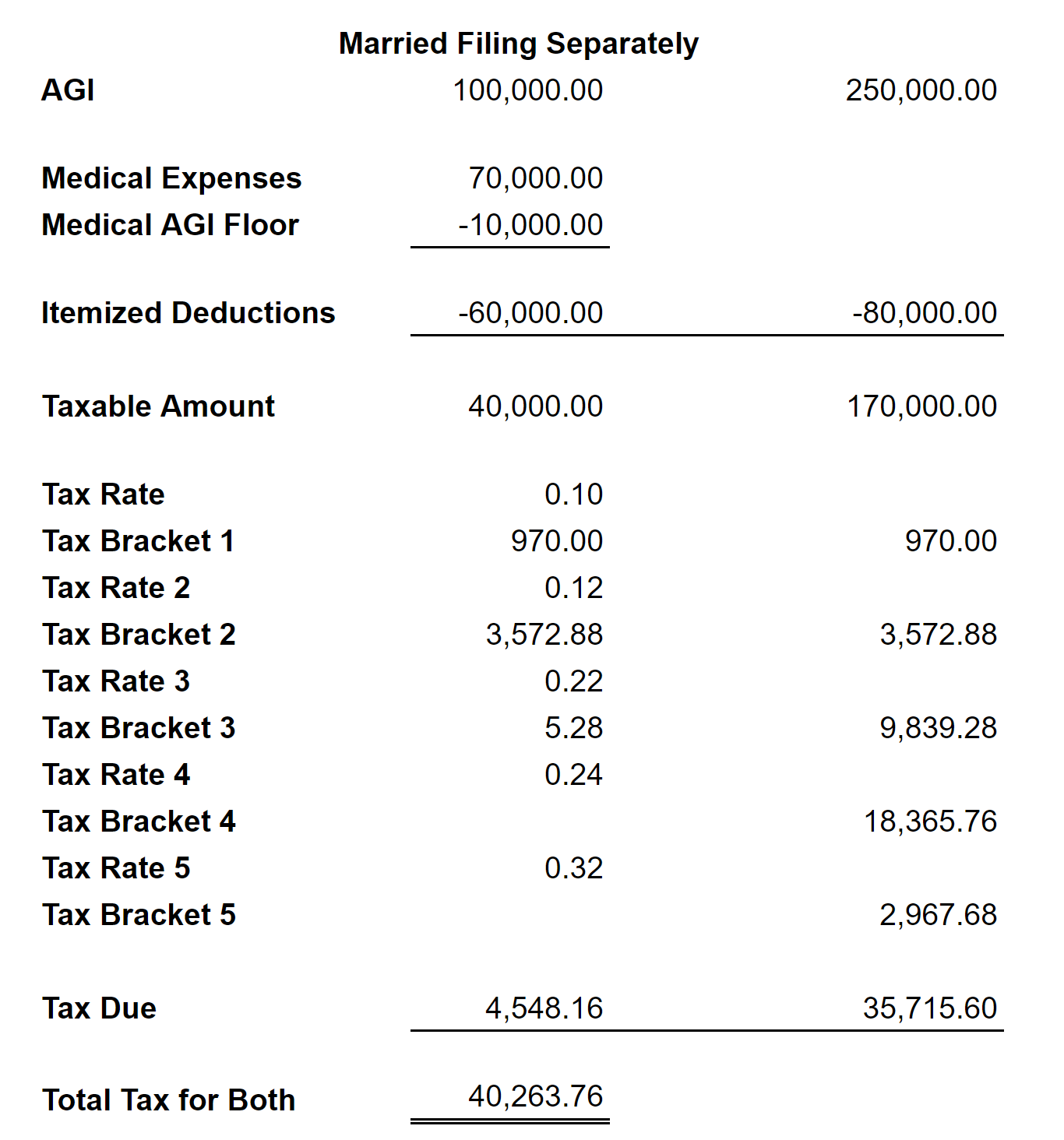

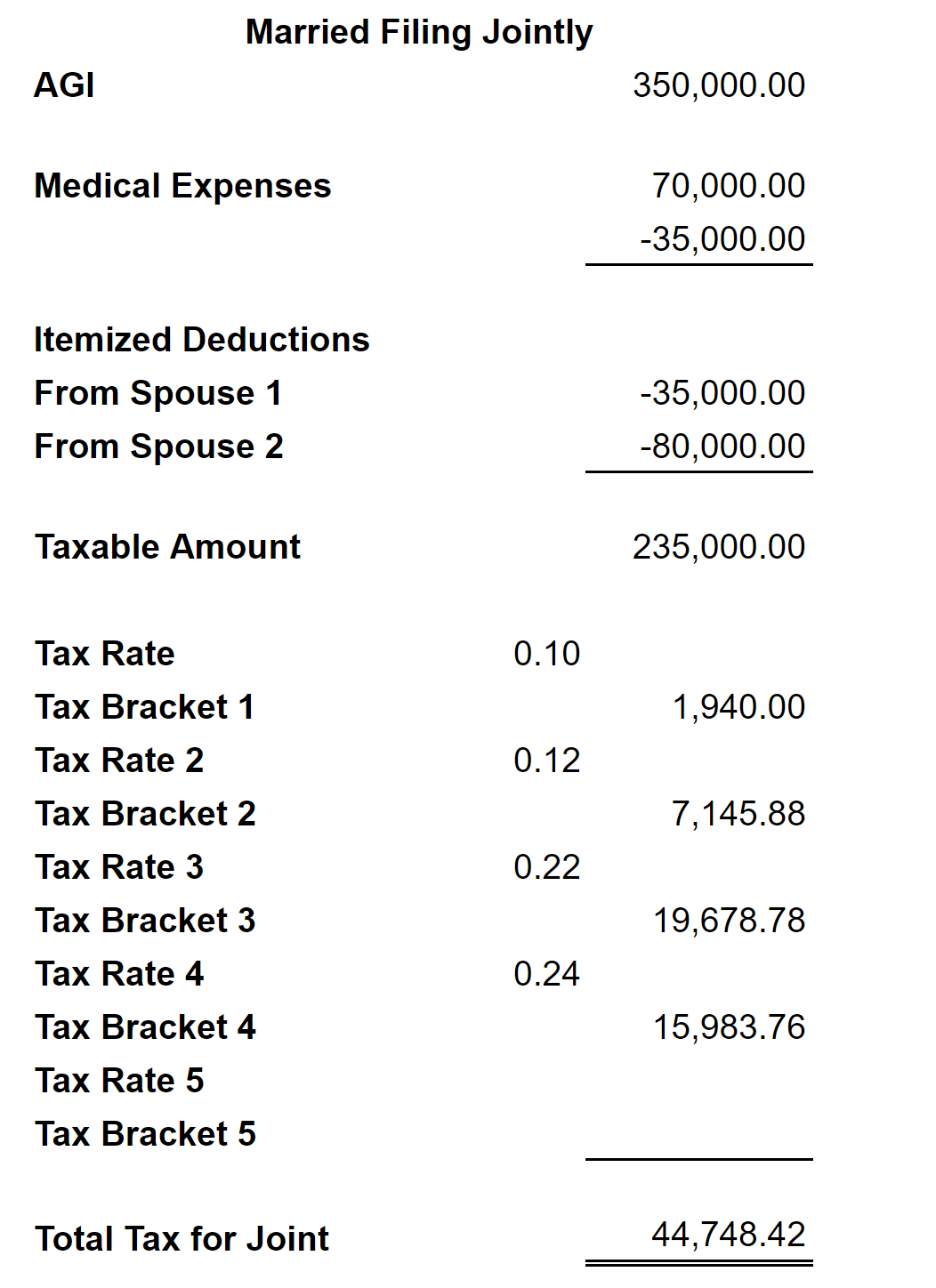

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Income Tax Formula Excel University

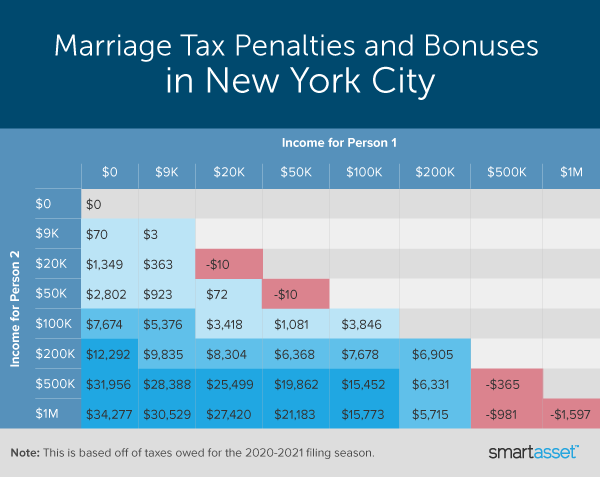

What Are Marriage Penalties And Bonuses Tax Policy Center

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Federal Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Tax Rate Calculator Flash Sales 54 Off Www Ingeniovirtual Com